Since the start of the Covid-19 pandemic, much comment and consideration has been provided as to the likely impact on the legal services industry. As time has passed, data to assess the early impact of the pandemic is now starting to appear, we felt it would be helpful to share with you the statistics for residential property purchases in the first half of 2020. Unsurprisingly, due to the COVID-19 pandemic, the number of residential conveyancing purchases dropped significantly during the course of 2020. To provide this analysis we have utilised the latest data which has become recently available from the Land Registry. This data is a record from the Land Registry of every registered property purchase by date of completion. On average, the number of purchases was down 37% for the first 6-months of 2020, however if we drill down further this increases to a 53.5% reduction for the second quarter (April-June).

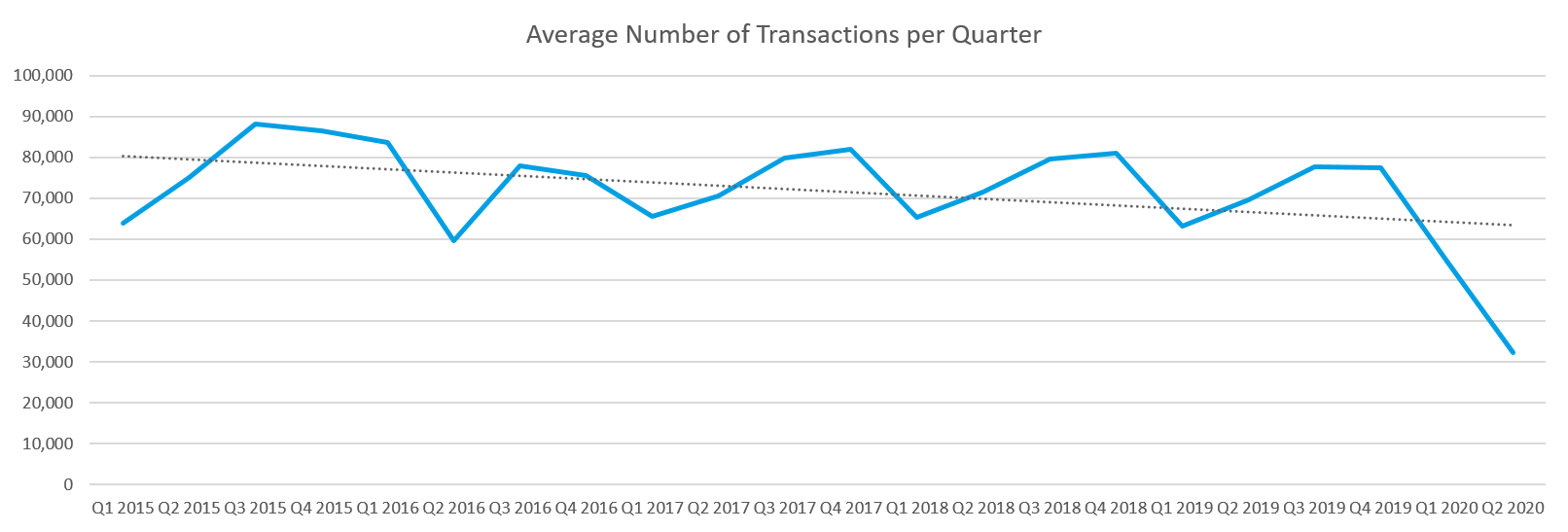

To perhaps best illustrate the impact of the COVID-19, it is important to compare not just against 12-months prior but at least five years. As shown on the graph below, the number of residential purchases per month has been fairly consistent since 2015. The spike in March 2016 resulting in almost double the number of transactions for that month was due to the Stamp Duty Land Tax (SDLT) changes unveiled which came in to effect in April 2016.

Naturally due to the national lockdown we would have expected a decrease in transactions during this period. However, what we did not necessarily expect to see was that the number of transactions recovered somewhat during May and June when the country was still largely in lockdown. What a higher than anticipated number of transactions for this period clearly highlights is the fluid adaptation of firms and workforces to new methods of working, and remote processes being implemented efficiently.

Equally, the historic data shows that the first and second quarter naturally has a lower amount of transactions and so some of the variance will be due to the seasonal cycle, however Q2 2020 is significantly below the normal fluctuation which is shown by an even more stark reality at a monthly level.

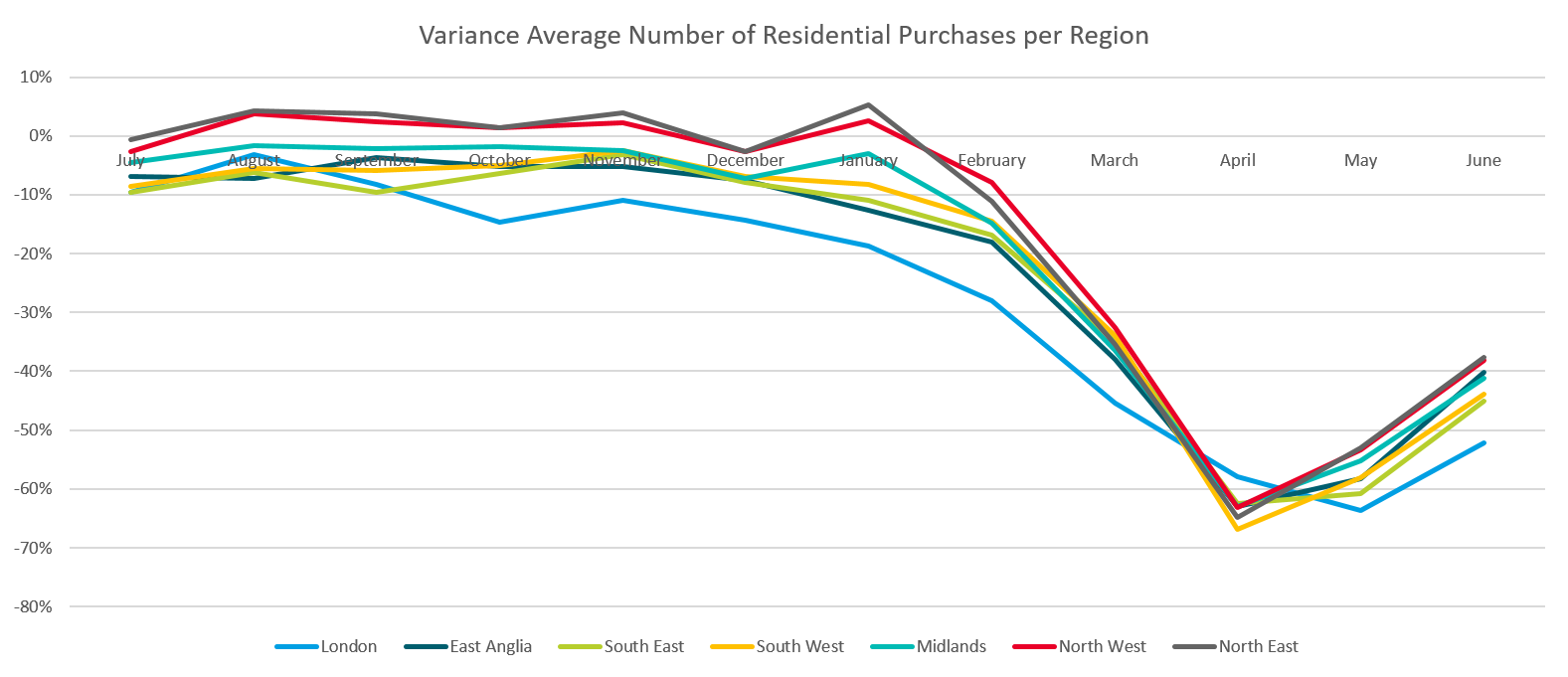

When reviewing the average number of purchases per month over the last five years, we can identify the variance of purchases for the last year. The graph below broadly splits this out by region of England & Wales for the period July 2019 to June 2020:

By considering at a regional level, we are able to identify that property purchases in London were lower than the average for the months October 2019 to January 2020 before the full lockdown in March, suggesting that there were other influences acting as a proverbial handbrake, one such possibility was continued Brexit uncertainty at the end of 2019.

Remarkably, with the exception of London, all regions of England & Wales followed the same pattern with April being the lowest point and recovery in the subsequent months thereafter.

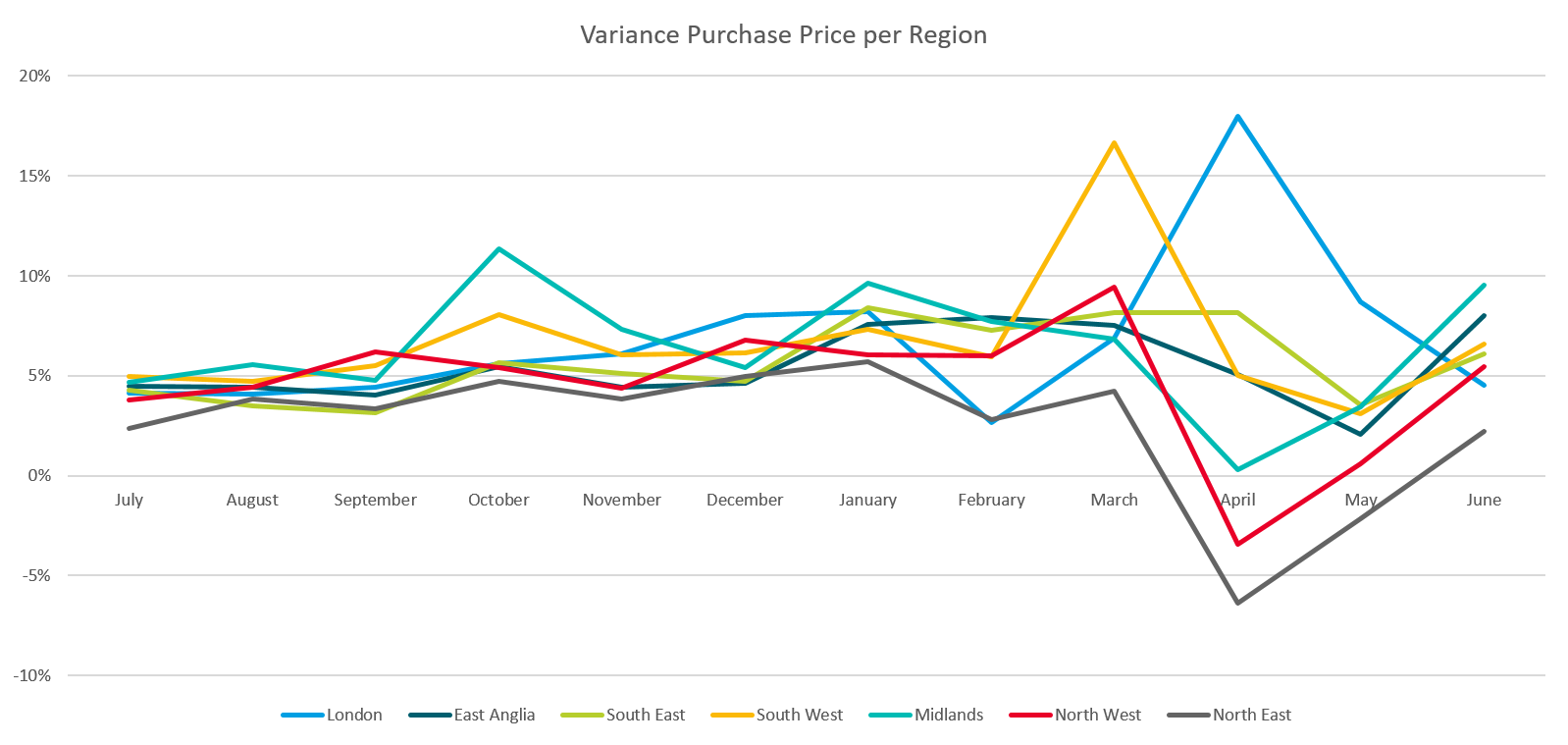

Similarly, if we look at the residential purchase prices for the same period, between July 2019 and February 2020 the increase is fairly consistent, however once the Government enforced lockdown was implemented in March 2020 the variance against the average purchase price drastically differs between region. It could be commented that the transactions that still managed to complete during this time were those of a higher property price in London and the South West, but interestingly the North East and North West experienced a drop in property prices.

It will be interesting to see how the number of transactions unfold over the next quarter, with the Chancellor's Stamp Duty Land Tax Holiday, which saw the limit risen from £125,000 to £500,000 until March 2021 expected to boost the number of purchases for those who may have been in limbo whilst the country was in lockdown. From discussions with our insureds for the October renewal period just gone, they have advised they have been busier than usual for this time of year, suggesting that by the end of 2020 and depending on any second lockdown not being as impactful, it could allow the property market and law firms to fully recover the loss of activity caused at the start of 2020.

Risk Management Advice

We look forward to updating you with the outcomes of Q3 and Q4 once the statistics are available from Land Registry. Precise numbers aside, what is abundantly clear is the amendments to SDLT and the impasse at the start of 2020 have and continue to result in an acceleration of transactions volumes. It is therefore essential to remember the importance of ensuring work is undertaken by individuals with the appropriate experience and that robust risk management processes are maintained. Caseloads of each fee earner should be carefully considered and regular monitoring in place, primarily to ensure fee earners do not become inundated, which will only increase the chance of a mistake happening. Finally, there will likely be even greater pressure as the SDLT levels revert to type towards the Spring of 2021, it is of vital importance that quality of work is not substituted with the need to complete by the cut-off date. Please see the link to an article we provided earlier this year which touches further on this point. As conveyancing continues to be the most prominent cause of claims among the Solicitors Profession, Insurers placed an even greater emphasis on conveyancing related question sets during the October renewal period and in light of the continued uncertainty the pandemic presents, you should expect this to continue moving in to 2021 renewals.

For our current clients, should you wish to discuss this further, please do contact your Lockton representative.

If you are not a current Lockton client but wish to discuss how best we can assist your firm at your next renewal, please do call 0330 123 3870 where a member of the team will be delighted to discuss with you. With remote working set to continue for the foreseeable future and resulting in increased time to obtain quotations, starting the renewal process as early as possible will give your firm the best chance of securing amicable renewal terms.